Customs Classification

When trading goods internationally, you will need to customs clear your merchandise for export in the country of departure and for import in the country of arrival. One of the essential steps for these customs’ clearance operations is to ensure that the customs authorities and other involved parties understand which kind of goods, which products are being exported or imported and this is done by customs classifying these goods.

To classify goods means to assign them a customs code by going through a catalog of codes and selecting a corresponding one, based notably on the goods’ description, nature, composition, physical form, manufacturing method or function.

The selected customs classification code will then be used, notably, by the customs and other authorities to assess and assign export or import duties and taxes to your merchandise, verify trade restrictions, and gather trade statistics.

It is the exporter (for export purposes) or importer (for import purposes) who is responsible for providing the correct classification, and an incorrectly declared classification code may result in penalties or fines.

The Harmonized System

For over 200 countries and 98% of international trade, these classification codes are based on an international nomenclature, an international list, for the customs classification of products called the Harmonized Commodity Description and Coding Systems (in short Harmonized System or HS).

Developed by the World Customs Organization, for its 200+ member countries, it is a catalog of over 5,300 products, articles, or commodities 6-digits codes and associated descriptions, organized in 21 sections and 97 chapters, and which enables the international classification of traded goods on a common basis.

For, example if your traded merchandise is Walnuts in their shell, its international Harmonized System customs classification code will be 0802.31, and this code can be decomposed as follows:

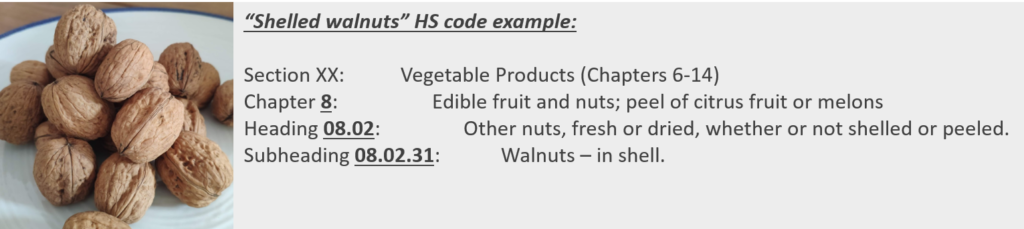

Whereas if it was Colored Pencils, its international Harmonized System customs classification code would be 9609.10, decomposed as follows:

This catalog and codes are then used, by the participating countries to classify goods for export and import purposes and to notably determine the customs duty rate.

National customs classification systems

A WCO member country may decide to use it directly, assigning duty rates to the 5300+ 6-digits (sub-heading) codes or can decide to extend it by adding additional digits for more granularity and further product break-down.

For example, the European Union uses an 8-digits system called the Combined Nomenclature (CN) for its exports and internally traded goods, and a 10-digits one called TARIC for its imports and for determining the import duties.

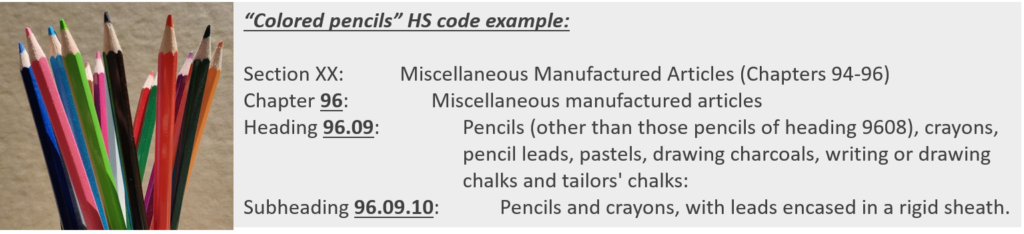

If you were importing your colored pencils to the European Union, you would classify them under the Taric code 9609.10.90.00 as their “leads” are not made of graphite but of wax and pigments.

And if you were importing them from a country which has not Free Trade Agreement established with the European Union, you know, you will have to pay duties amounting to 2.7% of the declared customs value of your merchandise.

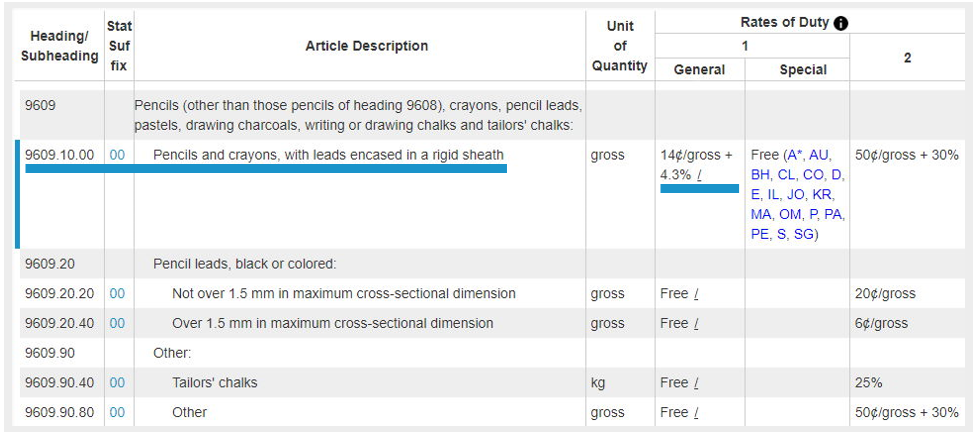

Whereas the United States use a 10-digits catalog, the Harmonized Tariff Schedule (HTS) for its imports and a different 10-digits catalog for its export called Schedule B.

If you were importing these pencils to the United States, you would use the HTS code 9609.10.00.00 “Pencils and crayons, with leads encased in a rigid sheath” and if no Free Trade Agreement is applicable you would need to pay duties of 14¢/gross* + 4.3% before the goods are released by the customs authorities.

*Gross is a unit of measure based on a squared dozen (122) or a dozen dozen hence 144 items. So in our example, you will need to pay 14¢ for every 144 colored pencils on top of the 4.3% of your declared value.

As you can see in these examples, the first 6-digits will be the same and come from the Harmonized System, with the following digits enabling the EU and the US to identify more specifically the products they want to tax at specific rates or providing more granularity, more details, to their trade tracking statistics.

In short

When exporting or importing goods, you will need to classify them and assign them a customs classification code, based on the classification system used in the concerned countries. These codes are then used for duty calculation, statistics and data gathering, rules of origin, monitoring of trade restrictions or controlled goods, and other possible purposes.

If you want to learn more about Customs Classification, please visit and register for our – currently free – online course here.

Allyn International provides a wide range of services in the areas of import and export compliance, allowing our clients to benefit from project specific work, as well as the day-to-day management of import and export compliance programs. Whether you need assistance with a specific project or if you would like to outsource your entire import operation, Allyn has the experience, tools, knowledge, and dedication to make sure your compliance needs are met.

Find out more here.