What is a Letter of Credit and how does it impact logistics?

Letters of Credit (LCs) are fundamental tools in international trade, providing security and trust between buyers and sellers who may not know each other personally.

This financial document, issued by a bank on behalf of the buyer, guarantees payment to the seller as long as specific conditions are met. This assurance facilitates smoother trade transactions by mitigating the risk for both parties.

How do Letters of Credit work?

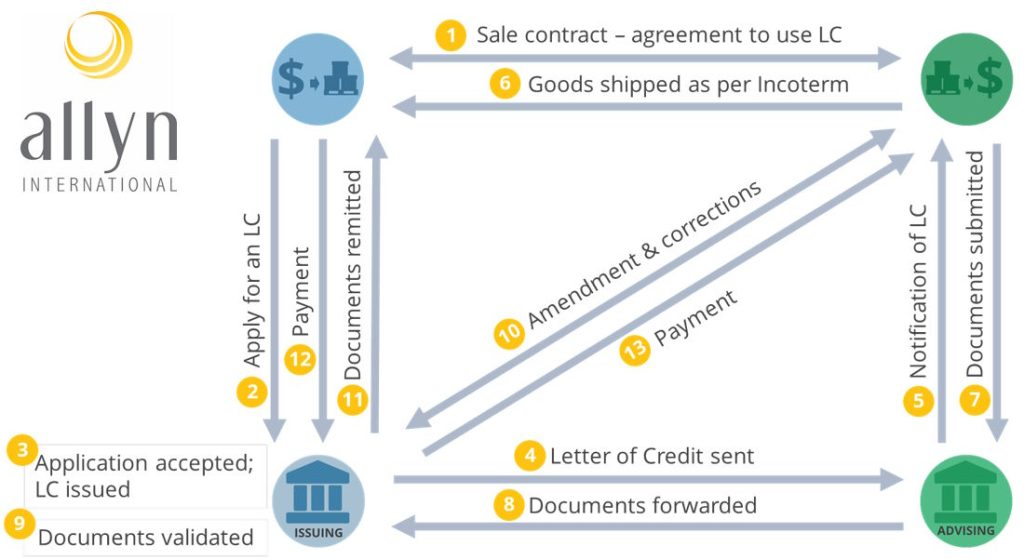

At its core, a Letter of Credit is a promise from the bank to pay the seller once the terms of the agreement are fulfilled. Here’s a simplified step-by-step breakdown of how an LC works:

- Agreement: The buyer and seller agree on the terms of the sale, including the use of a Letter of Credit.

- Issuance: The buyer requests their bank (issuing bank) to issue an LC in favor of the seller.

- Notification: The issuing bank sends the LC to the seller’s bank (advising bank), notifying them of the guarantee.

- Shipment: The seller ships the goods and collects the necessary documents that prove the terms of the LC have been met.

- Presentation: The seller presents these documents to their advising bank, which reviews them and forwards them to the issuing bank.

- Verification: The issuing bank verifies the documents against the LC requirements.

- Payment: If all terms are satisfied, the issuing bank releases the payment to the seller.

This process ensures that the seller receives payment as long as they comply with the agreed-upon conditions, and the buyer can be confident that the payment will only be made when the conditions are met.

In the below video – an extract from our Introduction to Letters of Credit eLearning – we review in X minutes the most common process flow of a Letter of Credit.

Types of Letters of Credit

Letters of Credit come in various types and variants, each tailored to specific trade needs and conditions.

Two very common examples include the irrevocable LC, which cannot be altered without the consent of all parties involved, and the confirmed LC, where a second bank (in addition to the issuing bank) guarantees payment, providing an extra layer of security for the seller.

Other examples include the standby LC, which acts as a backup payment method if the buyer fails to meet their payment obligations, and the red clause LC, which enables the seller to receive an advance payment from the issuing bank before shipping. These are just a few examples, and many other types and variants exist to accommodate different trading scenarios and requirements.

Documentary review and discrepancies

Validation of Letters of Credit is based solely on documentary review. In the process of validating an LC, the issuing bank checks all submitted documents for compliance with the LC terms.

For example, on an invoice, the bank ensures the description of goods matches the LC. On a packing list, they verify the quantity of goods is correct. On a bill of lading, they check the shipment date to ensure it falls within the specified range.

Any discrepancies, such as a mismatch in the description of goods on the invoice or an incorrect shipment date on the bill of lading, can lead to delays, penalties, or even non-payment.

Logistics considerations

Letters of Credit significantly influence logistics, so identifying shipments related to an LC is crucial.

The shipment request you receive should mention or flag this shipment as related to a Letter of Credit. If in doubt, you should reach out to the requestor to confirm. It is strongly recommended that for any LC-related shipment, you secure a copy of the LC to understand the logistics constraints it may generate.

An LC may, for example, impact the packaging, transport modes and methods, delivery schedules, labeling, Incoterms, and even the authorized vessel’s flag or ports to use for preparing and transporting your cargo. It will also provide requirements related to inspection, insurance, and surveys that need to be taken into account when organizing the transport.

Learn more with our Introduction to Letters of Credit course

For those involved in logistics, trade, or finance, understanding Letters of Credit is crucial. Our Introduction to Letters of Credit eLearning module offers a comprehensive overview, breaking down complex concepts into easy-to-understand sections.

This 85-minute course covers the basics, key terms, types of LCs, how they work, and their impact on logistics. It also provides practical examples, interactive elements, and a final exam to reinforce learning.

Ready to get started? Enroll in our Introduction to Letters of Credit course today and use code LOC15 to get 15% off the course.

For reference, you can find below the image version of the simplified Letter of Credit process presented in the linked video:

We hope you enjoyed this article and if you want to learn more about logistics in general – you can take a look at our article The supply chain – its material and logistics flows