When involved in more complex or riskier international trade operations, a buyer or seller may want to take extra steps to secure and guarantee delivery or payment and to do so they will commonly rely on a bank issued Letter of Credit (LC, LOC, L/C).

Letter of credit definition:

- A Letter of Credit is a financial document issued by a bank on behalf of a buyer.

- It guarantees that payment will be made to the seller upon presentation of specified documents and compliance with agreed-upon terms and conditions.

- It serves as a secure method of facilitating international trade transactions by mitigating payment risks for both the buyer and the seller.

In plain English – a Letter of Credit is a promise of a bank to pay a seller on behalf of a buyer once certain specific delivery conditions are met.

Expand on this Letter of Credit definition with our article What is a Letter of Credit, here – or take our eLearning course here.

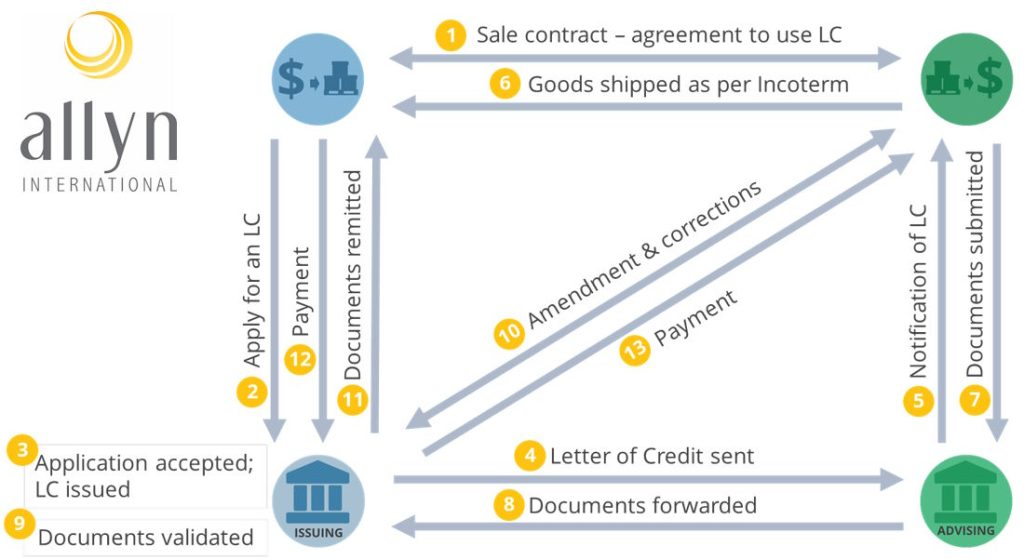

You can find below a simple process flow for the most common types of Letters of Credit: